This blog has been reposted from our article on the Forbes | Coaches Council. Check out the original article here!

I keep turning down lucrative job offers.

The conversation with my sister usually goes something like this:

Me: “I was talking to a potential client about a project and they recruited me for a full-time job instead.”

Her: “Don’t they know you don’t want to work?”

“Don’t want to work” isn’t really the best way to put it. Prior to starting my own business, I worked extremely hard. I love tackling challenging problems and building teams, and I have remained close friends with coworkers throughout my career.

This is not a post about my wonderful track record or how great I think I am, but it’s actually about understanding what you value in life. I started my company at the end of 2019 after I was fired from my last job. In the beginning, it was an uphill battle—I was insecure about whether I would be successful, and I was constantly looking for another full-time job. Basically, I had one foot in and one foot out.

While building my business during a pandemic was highly challenging…

I am glad that I was not successful in finding a job (thank you again, pandemic). In a time when the world was changing at such a rapid pace, I appreciated the fact that I could choose whether I visited my clients at their offices face-to-face or met virtually. I did not have to conform to the requirements of an employer, pivoting from working in an office to working at home or hybrid and back, all while juggling the same for my child.

I got to experience a level of freedom that I had never experienced before. And it isn’t the same kind of freedom where employees got to work from anywhere. This is the kind of freedom where I could pull an all-nighter if I was so inspired, then sleep in until noon. This is the kind of freedom where I could block off my calendar for the rest of the day because I wanted to go to the pool or watch my kid’s track meet (that he never gives me advance notice about). This is the kind of freedom where I don’t have to put energy into office toxicity du jour.

And just like they say about love, I guess the same is true for job offers:

They come when you’re not looking.

The first time I was recruited, I entertained the idea. I ran the numbers. I declined. Now I just mostly decline even being recruited because I don’t want to waste anyone’s time. The jobs ranged anywhere from $300,000 to $500,000 plus stocks or shares.

These are the kinds of jobs I dreamed of getting when I was starting out in my career. The difference is that I now know how much dedication is required when you take those kinds of positions. It’s the kind of dedication that makes you unable to plan for trips, even if you had time to take a vacation, or unable to decide what to eat for dinner because you have given every ounce of energy to your work.

I don’t make that much per year as a solopreneur, but that’s because I choose to not work full-time. On an hourly basis (averaged over all my activities, including writing this article; this is not my bill rate), I make $250 per hour. Translated to a full-time job, it matches the $500,000 per year—only if it’s truly 40 hours a week. These positions are typically 60 hours per week or more.

I so wish a true work-life balance can happen in the corporate world, but it hasn’t. At least not to anyone that I know. In the absence of that, I craft my life so I can have the equality and equity I deserve.

You can also start crafting your life to have the equality and equity you deserve, but it doesn’t happen overnight.

First, take stock of your financial health.

If your finances could use a boost, here are some steps to improve your financial health:

1. Understand your income requirements. Calculate what you need on an annual basis to keep the lights on and everyone fed.

2. What discretionary expenses are you willing to part with (e.g., restaurants, salons, subscription boxes, and streaming platform subscriptions) or reduce (e.g., driving versus flying, Airbnb versus five-star hotels)?

3. Add up the essential and discretionary expenses that you’d like to keep (you must have some fun) to arrive at your monthly budget.

4. Open a separate bank account and transfer the difference between your take-home pay and budget every time you get a paycheck. This last step is very important because you are building structure to prevent your old spending habits from kicking in.

Second…

Develop an investment strategy to build wealth and earn passive income. Your strategy should be based on your interests, existing investments, risk tolerance, and access to capital (good credit score). Here’s a list of ideas; my favorite is rental real estate.

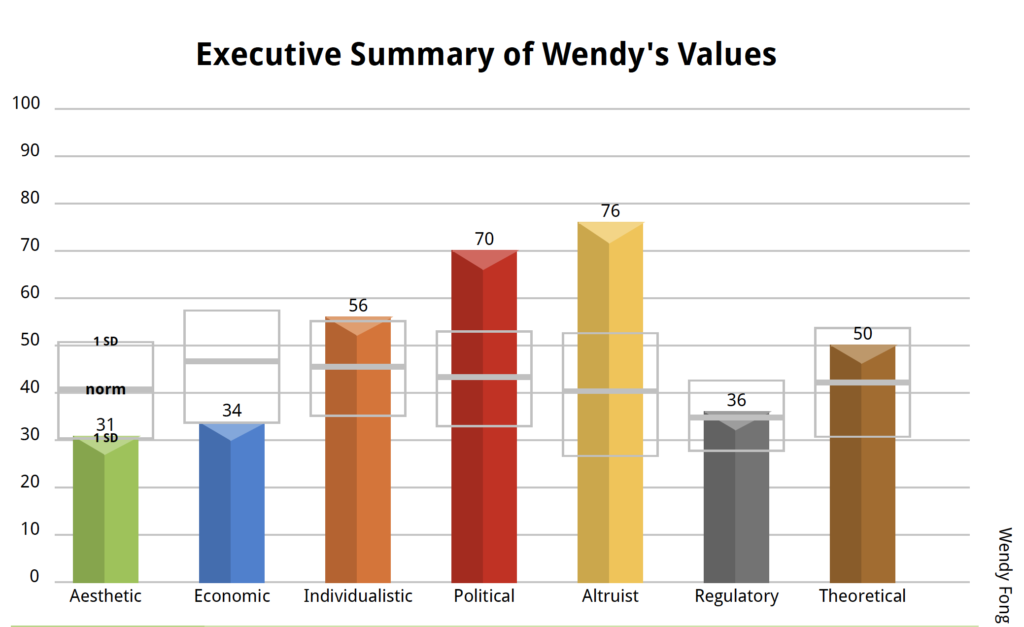

Lastly, consider taking a values assessment if you are unclear about what exactly drives you.

I took one and scored low on Economic (while not driven by money, you may be sensitive to perceived inequities in wages and salaries, and do not want to be taken advantage of in that process) and high on Individualistic (you prefer to make your own decisions about how an assignment or project is to be accomplished). It makes perfect sense that I like to do consulting work on my own but don’t feel the need to work 80 hours a week to build a multinational conglomerate. Someone with values the opposite of mine will have a very different dream life.

So now that you have a few tools in your craft box, start crafting!

Want to learn more about personal self-awareness? Take a listen to Dan Harris’ Podcast: The Painful Treasure of Self-Awareness