This article was originally published on Rice University’s lilie blog on February 22, 2021.

In my last post, I discussed how behavioral analytics could be used for start-ups. Here, I’ll dive into how private equity, growth equity, and venture capital firms are utilizing people’s data.

Study after study puts the failure rate of mergers and acquisitions somewhere between 70% and 90% (2011, HBR). One KPMG study narrowed the band of M&A failures from 75% to 83% (2015, KPMG). One constant in the research is that the larger the deal, the higher the chances of failure.

A FAILED MERGER, ACQUISITION, OR DIVESTITURE CAN BE UNDERSTOOD IN 2 WAYS:

- Qualitative – What companies had in mind that caused them to merge in the first place ultimately doesn’t work out that way.

- Quantitative – shareholders suffer because operating results deteriorate instead of improving.

Deloitte’s M&A Trends 2020 reports that 38% of PE firms cite revenue and growth improvement strategies as their primary strategy or focus area for driving value in their portfolio companies.

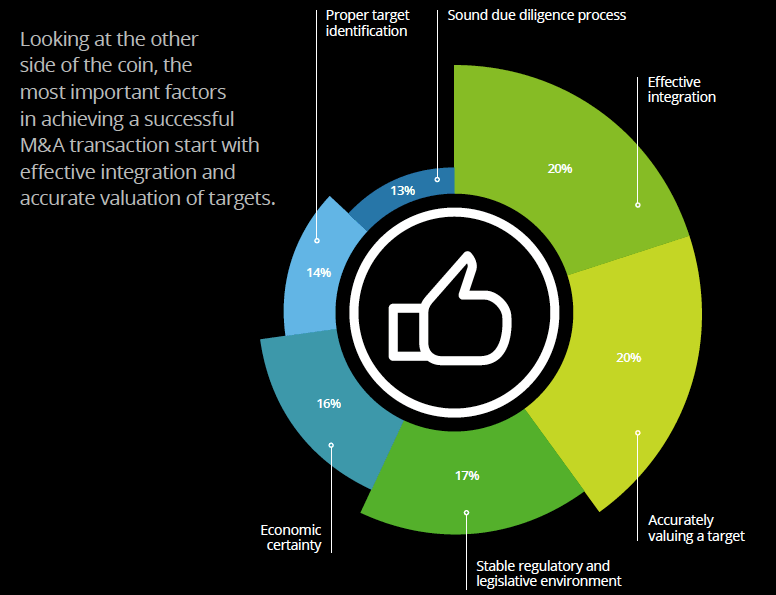

In the same report, EFFECTIVE INTEGRATION is key to the success of the deal. It accounts for 20% of a successful transaction, tied for top place with ACCURATELY VALUING A TARGET.

Post-M&A integration is defined as the implementation of changes in functional activities, and organizational structures. This also includes the cultures of the two organizations to expedite their consolidation into a functional whole. Of course, this all involves people.

Moreover, Aon Hewitt’s research shows that:

- There is a 23% increase in “actively disengaged employees” after change events – even if no one’s job is affected.

- It takes about three years to return to pre-merger engagement levels.

With these figures, it is startling that there is much less focus on talent. Executives attribute 72% of their company’s value to their employees. However, a mere 12% of companies align their talent strategy with their business strategy (Predictive Index, The 2020 State of Talent Optimization).

HOW ARE INVESTORS IN THE PRIVATE MARKET CHANGING THE TIDE?

According to Mike Zani, CEO of The Predictive Index, “When you look at the world of PE, growth equity, and to a lesser extent, VC, we are starting to see more talent officers, someone on staff to assist with strategic HR challenges with their portfolio.” For example, Vista Equity has a consulting division that is solely focused on the talent and people analytics of its portfolio companies. They go beyond just finding the right executives, they have proprietary analytics tools to add value.

THERE ARE THREE USE CASES FOR ANALYTICS WITHIN THE PRIVATE MARKET:

1. Due Diligence

“One of the most powerful ways behavioral analytics are used for due diligence is an understanding of the strengths and blind spots of the future leadership team. It’s about applying analytical rigor to the people side of the business to create a nuanced understanding of individual and team dynamics so you can be intentional about how to enable and de-risk the execution of future growth plans. We surface people challenges and opportunities early in the process so our clients can put strategies in place for effective change management and talent optimization.” Heather Haas, President, ADVISA.

After signing a letter of intent, a consultant can assess the leadership team with behavioral, cognitive, and organizational assessments. In the process of evaluating leadership fit, consultants may identify gaps between the leadership abilities needed and those present in the executive team, and investors must focus attention on closing those gaps. It is much easier to suggest fixing them before the deal is closed, where investors can work with the company to create leadership development or hiring plans. If investors discover that the executive team lacks financial or operational excellence 6 months after close, it is going to be much harder to communicate that in a positive, forward-looking way.

Predictive Index isn’t the only tool used for due diligence. Specialty consulting firms that provide due diligence support with people analytics include GH Smart, Green Peak Partners, Korn Ferry, and Deloitte. They use a host of tools ranging from Hogan assessments to proprietary software. “Out of the 150 PE clients with The Predictive Index,” Zani says “about 1/3 are using it in due diligence regularly.”

2. Post-Deal Value Creation

Effective M&A integration accounts for 20% of the success of a deal. As I mentioned in the last post, behavioral analytics can provide insights that allow each person to easily understand how their new team members are wired. This can drastically reduce the time it takes to build cohesion among the group and make for more effective collaboration as project teams are regularly assembled and reassembled. Put simply, instead of using our energy to try to figure each other out, we cut through the noise so we can run faster.

3. Scale

The use of behavioral analytics for hiring is nothing new. With an infusion of cash, one of the first things a company does in response to growth goals is to hire. People data can help companies scale quickly and with confidence. Max Yoder, CEO, and Founder of Lessonly shares about Predictive Index, “Now, every time we hire, we use the assessments as another tool in our toolkit. The results will never decide whether a person gets hired or not, but they do provide guidance as to whom should be in sales, who should be in client experience, who should sit in a quiet space, and who thrives on the commotion.”

Even with such impressive results, still there are two schools of thought when it comes to how much control private market firms want to have over the operations of their portfolio companies. General Catalyst, the PE firm that invested in Predictive Index, in particular, says they don’t want to be the management team.

Kirk Arnold, Executive In Residence, General Catalyst says “We’re very founder supportive. We invest in entrepreneurs and innovators and work to support them. We share feedback and insights with those teams – and encourage them to The Predictive Index toolset to help them scale effectively. But we don’t force any of our teams to invest in any particular tool or strategy. We believe great businesses are built by great teams, and we believe that PI can help companies excel in team building – but we look to the leadership team to make those investment decisions based on their needs and culture.”

Prior to becoming a Predictive Index Consultant, I spent five years integrating acquisitions. I only had access to PI for the very last year. It was so powerful in building dream teams that I wished I had known about it sooner. Areas I used PI heavily were post-deal value creation as well as scaling. In my current practice, I spend about 20% of my time performing due diligence for start-ups as well as working with them to round out their team from a data-driven perspective.